Arizona Form 140 - Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Web personal income tax return filed by resident taxpayers. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. Web who can use arizona form 140? Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022. Individual estimated tax payment booklet: You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

Printable Az 140 Form Printable Forms Free Online

Web personal income tax return filed by resident taxpayers. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Web we last updated the resident personal income tax return in february 2023, so this is the latest version of.

Arizona Form 140nr Nonresident Personal Tax Return 2013

Web who can use arizona form 140? Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022. Individual estimated tax payment booklet: Web personal income tax return filed by resident taxpayers. Web most taxpayers are required to file a yearly income tax.

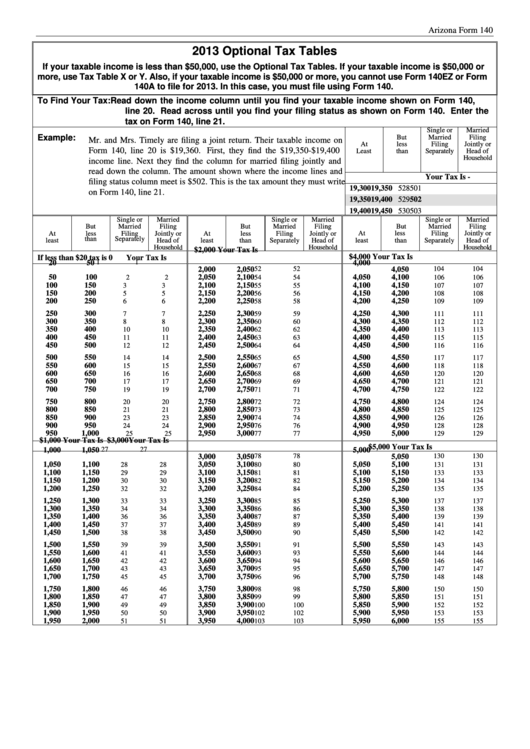

Arizona Form 140 Optional Tax Tables 2013 printable pdf download

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. You, and your spouse if married.

Printable Arizona Tax Form 140 Printable Forms Free Online

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Individual estimated tax payment booklet: You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. You.

AZ DoR 140 Instructions 20202021 Fill out Tax Template Online US

Web who can use arizona form 140? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Individual estimated tax payment booklet: Web we last updated the resident personal income tax return in february 2023, so this is the.

Instructions and Download of Arizona Form 140 Unemployment Gov

You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. You may file form 140 only.

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Web who can use arizona form 140? Web personal income tax return filed by resident taxpayers. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Web we last updated the resident personal income tax return in february 2023,.

Printable Arizona Tax Form 140 Printable Forms Free Online

Individual estimated tax payment booklet: Web personal income tax return filed by resident taxpayers. Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022. Web most taxpayers are required to file a yearly income tax return in april to both the internal.

Fillable Online Arizona Form 140IA Arizona Department of Revenue Fax

Web who can use arizona form 140? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of.

Arizona Form 140EZ (ADOR10534) Download Fillable PDF or Fill Online

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Web personal income tax return filed by resident taxpayers. Individual estimated tax payment booklet: Web who can use arizona form 140? You may file form 140 only if you.

Web personal income tax return filed by resident taxpayers. Individual estimated tax payment booklet: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. You, and your spouse if married filing a joint return, may file form 140 only if you are full year residents of arizona. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022. Web who can use arizona form 140?

You, And Your Spouse If Married Filing A Joint Return, May File Form 140 Only If You Are Full Year Residents Of Arizona.

Individual estimated tax payment booklet: Web we last updated the resident personal income tax return in february 2023, so this is the latest version of form 140, fully updated for tax year 2022. Web personal income tax return filed by resident taxpayers. Web who can use arizona form 140?

You May File Form 140 Only If You (And Your Spouse, If Married Filing A Joint Return) Are Full Year Residents Of Arizona.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a.