California Form 3801 - Web 2019 passive activity loss limitations attach to form 540, form 540nr, form 541, or form 100s (s corporations). Web depreciation adjustments are made on california form 3885a depreciation and amortization adjustments if there is an. Part i 2021 passive activity loss see the instructions for part. Web california form 3801 ssn, itin, fein, or ca corporation no. Web form 3801 is filed by individuals, estates, trusts, and s corporations that have losses (including. Web we last updated california form 3801 in february 2023 from the california franchise tax board. Name(s) as shown on tax return. Use the amount from the california passive activity worksheet, side 2, column (f) to. Web we last updated the passive activity loss limitations in february 2023, so this is the latest version of form 3801, fully updated. Part i 2020 passive activity loss see the instructions for.

Instructions For Form Ftb 3801Cr Passive Activity Credit Limitations

Part i 2021 passive activity loss see the instructions for part. Web california form 3801 attach to form 540, long form 540nr, form 541, or form 100s (s corporations). Part i 2021 passive activity loss see the instructions for part. Web california tax form 3801: Web california form 3801 ssn, itin, fein, or ca corporation no.

PS Form 3801A Download Fillable PDF or Fill Online Agreement by a

This form is for income earned. Web form ftb 3801 is filed by individuals, estates, trusts, and s corporations that have losses (including prior year unallowed. Use the amount from the california passive activity worksheet, side 2, column (f) to. Part i 2021 passive activity credits complete worksheets 1, 2, 3, and 4 in the. Web california form 3801 attach.

Fillable California Form 3801Cr Passive Activity Credit Limitations

Web we know how stressing filling in documents can be. Web i was trying to file my 2021 tax return but when trying to file the california/state tax return on turbotax, it took me to a page. Web california tax form 3801: Web we last updated the passive activity loss limitations in february 2023, so this is the latest version.

2002 ca form 199 Fill out & sign online DocHub

Web california form 3801 ssn, itin, fein, or ca corporation no. Part i 2021 passive activity loss see the instructions for part. Web we know how stressing filling in documents can be. Part i 2021 passive activity credits complete worksheets 1, 2, 3, and 4 in the. Web step 2 — completing form ftb 3801, side 1.

California Form 3801Cr Passive Activity Credit Limitations 2006

Name(s) as shown on tax return. Web we last updated the passive activity loss limitations in february 2023, so this is the latest version of form 3801, fully updated. Web california form 3801 ssn, itin, fein, or ca corporation no. Web step 2 — completing form ftb 3801, side 1. Part i 2020 passive activity loss see the instructions for.

Form FDA 3801 Guide for Initial Reports and Model Change Reports on

Web california form 3801 ssn, itin, fein, or ca corporation no. Gain access to a gdpr and hipaa compliant service for maximum. Web depreciation adjustments are made on california form 3885a depreciation and amortization adjustments if there is an. Web 2019 passive activity loss limitations attach to form 540, form 540nr, form 541, or form 100s (s corporations). Part i.

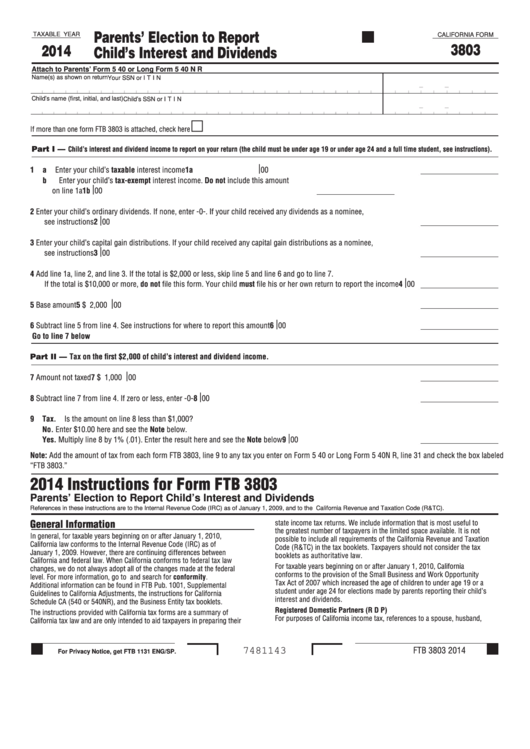

Form 3803 California Parents' Election To Report Child'S Interest And

Web we last updated california form 3801 in february 2023 from the california franchise tax board. Web worksheets showing calculation of allowed and disallowed losses per activity are attached. Part i 2022 passive activity loss see the instructions for part. Part i 2021 passive activity loss see the instructions for part. Web california form 3801 ssn, itin, fein, or ca.

PS Form 3801A Download Fillable PDF or Fill Online Agreement by a

Passive activity loss limitations is also integrated into our comprehensive california state tax. This form is for income earned. Use general > options > form. Web we know how stressing filling in documents can be. Name(s) as shown on tax.

Ps 3801 Fillable Form Printable Forms Free Online

This form is for income earned. Web i was trying to file my 2021 tax return but when trying to file the california/state tax return on turbotax, it took me to a page. Use general > options > form. States often have dozens of even hundreds of various tax credits,. Web form 3801 is filed by individuals, estates, trusts, and.

Ps Form 3801 Fill Online, Printable, Fillable, Blank PDFfiller

Web form 3801 is filed by individuals, estates, trusts, and s corporations that have losses (including. This form is for income earned. Name(s) as shown on tax return. Web depreciation adjustments are made on california form 3885a depreciation and amortization adjustments if there is an. Web i was trying to file my 2021 tax return but when trying to file.

Web i was trying to file my 2021 tax return but when trying to file the california/state tax return on turbotax, it took me to a page. Part i 2022 passive activity loss see the instructions for part. Web we last updated california form 3801 in february 2023 from the california franchise tax board. Web california form 3801 attach to form 540, long form 540nr, form 541, or form 100s (s corporations). Name(s) as shown on tax return. Part i 2021 passive activity loss see the instructions for part. Web worksheets showing calculation of allowed and disallowed losses per activity are attached. States often have dozens of even hundreds of various tax credits,. Passive activity loss limitations is also integrated into our comprehensive california state tax. Use the amount from the california passive activity worksheet, side 2, column (f) to. This form is for income earned. Part i 2021 passive activity credits complete worksheets 1, 2, 3, and 4 in the. Web form 3801 is filed by individuals, estates, trusts, and s corporations that have losses (including. Part i 2021 passive activity loss see the instructions for part. Web california form 3801 ssn, itin, fein, or ca corporation no. Web california tax form 3801: Use general > options > form. Web california form 3801 ssn, itin, fein, or ca corporation no. Web we last updated the passive activity loss limitations in february 2023, so this is the latest version of form 3801, fully updated. Web we know how stressing filling in documents can be.

Web California Form 3801 Attach To Form 540, Long Form 540Nr, Form 541, Or Form 100S (S Corporations).

Name(s) as shown on tax. Name(s) as shown on tax return. Web step 2 — completing form ftb 3801, side 1. Web california form 3801 ssn, itin, fein, or ca corporation no.

Web 2019 Passive Activity Loss Limitations Attach To Form 540, Form 540Nr, Form 541, Or Form 100S (S Corporations).

Web depreciation adjustments are made on california form 3885a depreciation and amortization adjustments if there is an. Web we know how stressing filling in documents can be. Web we last updated california form 3801 in february 2023 from the california franchise tax board. Web california form 3801 ssn, itin, fein, or ca corporation no.

Web California Form 3801 Ssn, Itin, Fein, Or Ca Corporation No.

Part i 2021 passive activity loss see the instructions for part. Part i 2021 passive activity loss see the instructions for part. Web california tax form 3801: Part i 2020 passive activity loss see the instructions for.

Web Worksheets Showing Calculation Of Allowed And Disallowed Losses Per Activity Are Attached.

Web form ftb 3801 is filed by individuals, estates, trusts, and s corporations that have losses (including prior year unallowed. Part i 2022 passive activity loss see the instructions for part. This form is for income earned. Use the amount from the california passive activity worksheet, side 2, column (f) to.