Colorado Form 104Pn - Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of. We recommend you review income tax topics:

Fill Free fillable Form 104PN PartYear Resident/Nonresident Tax

Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. We recommend you review income tax topics:

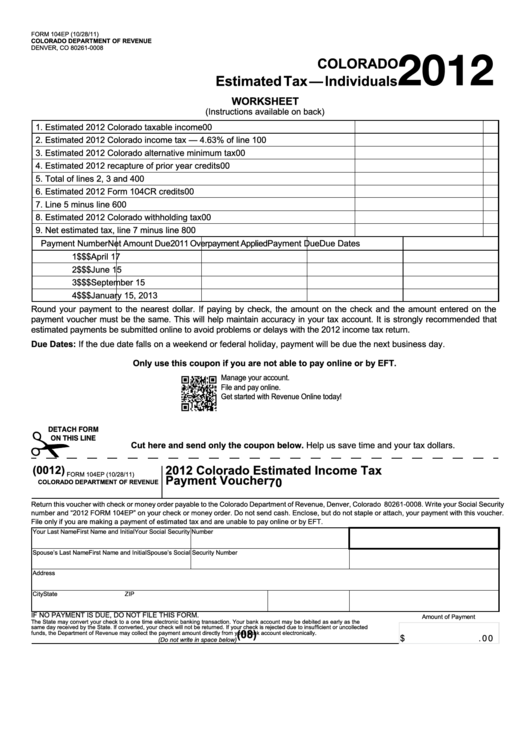

Form 104ep Colorado TaxIndividuals Worksheet 2012 printable pdf

Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. We recommend you review income tax topics:

TaxHow » Colorado Tax Forms 2017

We recommend you review income tax topics: Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony.

2020 Form CO DoR 104PN Fill Online, Printable, Fillable, Blank pdfFiller

Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. We recommend you review income tax topics:

Colorado Form 104Pn ≡ Fill Out Printable PDF Forms Online

Use this form if you and/or your spouse were a resident of. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. We recommend you review income tax topics: Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony.

Colorado Tax Table Form 104pn

Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of. We recommend you review income tax topics:

Form 104pn PartYear Resident/nonresident Tax Calculation Schedule

We recommend you review income tax topics: Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of.

2013 colorado 104pn form Fill out & sign online DocHub

We recommend you review income tax topics: Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of.

Printable Colorado Tax Form 104 Printable Forms Free Online

Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. We recommend you review income tax topics: Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of.

Fillable Form 104 Colorado Individual Tax 2013 printable pdf

Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. We recommend you review income tax topics: Use this form if you and/or your spouse were a resident of.

Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. We recommend you review income tax topics: Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony.

Web Tax Is Prorated So That It Is Calculated Only On Income Received In Colorado Or From Sources Within Colorado.

Use this form if you and/or your spouse were a resident of. We recommend you review income tax topics: Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony.