Form Ct-2210 - Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. If you are filing electronically, select the indicator for. Ensure you are using the 2020 form to properly calculate the amount of. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers:

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. If you are filing electronically, select the indicator for. Ensure you are using the 2020 form to properly calculate the amount of. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers:

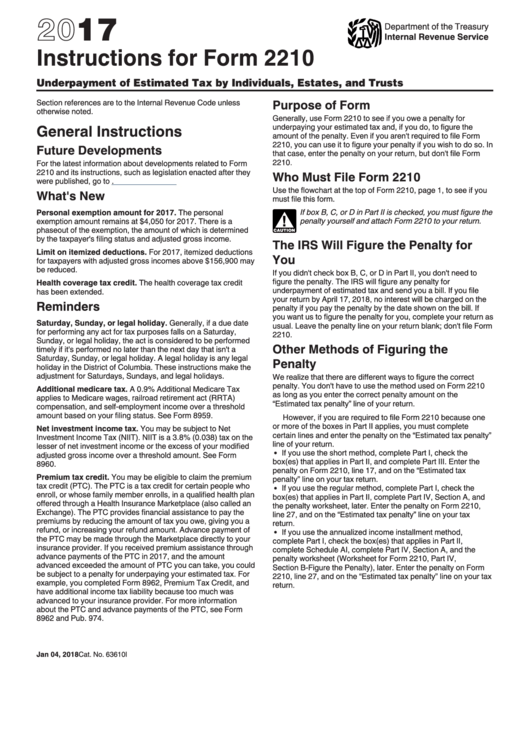

Instructions For Form 2210 Underpayment Of Estimated Tax By

12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: Ensure you are using the 2020 form to properly calculate the amount of. If you are filing electronically, select the indicator for. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident.

Fillable Form Ct2210 Underpayment Of Estimated Tax By

Ensure you are using the 2020 form to properly calculate the amount of. If you are filing electronically, select the indicator for. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident.

Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Ensure you are using the 2020 form to properly calculate the amount of. If you are filing electronically, select the indicator for. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers:

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. Ensure you are using the 2020 form to properly calculate the amount of. If you are filing electronically, select the indicator for.

Ssurvivor Irs Form 2210 Instructions 2020

12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: If you are filing electronically, select the indicator for. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. Ensure you are using the 2020 form to properly calculate the amount of.

Form Ct2210 Underpayment Of Estimated Tax By Individuals

Ensure you are using the 2020 form to properly calculate the amount of. If you are filing electronically, select the indicator for. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers:

Form Ct 2210 ≡ Fill Out Printable PDF Forms Online

If you are filing electronically, select the indicator for. Ensure you are using the 2020 form to properly calculate the amount of. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers:

Instructions For Form 2210 Underpayment Of Estimated Tax By

If you are filing electronically, select the indicator for. Ensure you are using the 2020 form to properly calculate the amount of. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident.

Form 2210 Worksheet In152a Annualized Installment Method

Ensure you are using the 2020 form to properly calculate the amount of. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: If you are filing electronically, select the indicator for.

If you are filing electronically, select the indicator for. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. Ensure you are using the 2020 form to properly calculate the amount of.

If You Are Filing Electronically, Select The Indicator For.

Ensure you are using the 2020 form to properly calculate the amount of. 12/22) underpayment of estimated income tax by individuals, trusts, and estates 2022 electronic filers: Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident.