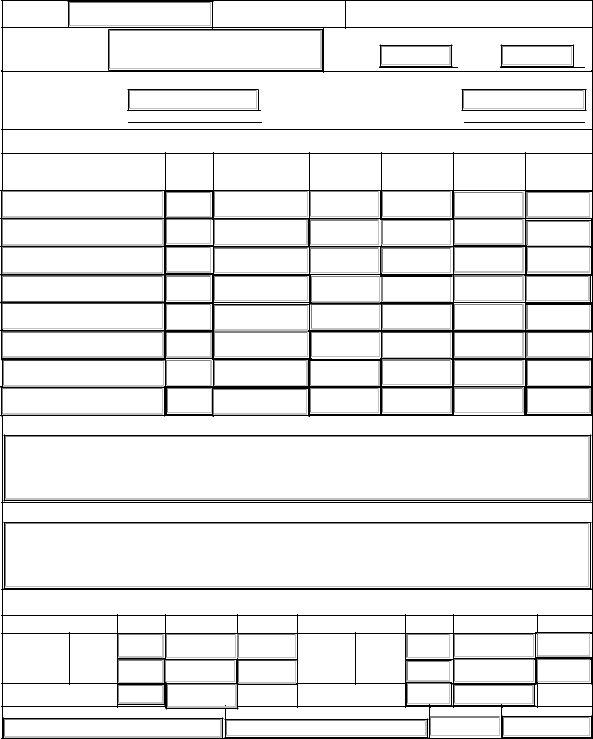

Form It-204-Ip - Find the template from the library. Used to report income, deductions, gains, losses and. Web 19 rows partnership return; But every partnership having either (1) at least one. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. This form is only prepared for individual, estate and trust or partnership partners. Get the it 204 ip form you want. Partnerships are not subject to personal income tax. If this form is desired.

Fillable Online tax ny e s 1 it 204 ip form Fax Email Print pdfFiller

Partnerships are not subject to personal income tax. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. If this form is desired. But every partnership having either (1) at least one. Used to report income, deductions, gains, losses and.

Instructions for Form IT204LL

Find the template from the library. This form is only prepared for individual, estate and trust or partnership partners. Get the it 204 ip form you want. Web 19 rows partnership return; Partnerships are not subject to personal income tax.

Download Instructions for Form IT204IP Schedule K1 New York Partner

But every partnership having either (1) at least one. If this form is desired. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. Partnerships are not subject to personal income tax. This form is only prepared for individual, estate and trust or partnership partners.

Ics Form 204 ≡ Fill Out Printable PDF Forms Online

Web 19 rows partnership return; Find the template from the library. If this form is desired. Get the it 204 ip form you want. Partnerships are not subject to personal income tax.

Download Instructions for Form IT204 Partnership Return PDF, 2020

Used to report income, deductions, gains, losses and. This form is only prepared for individual, estate and trust or partnership partners. Partnerships are not subject to personal income tax. If this form is desired. Get the it 204 ip form you want.

PPT Unit 5 Planning Process, IAP, and Operations Briefs PowerPoint

Find the template from the library. Used to report income, deductions, gains, losses and. If this form is desired. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. Web 19 rows partnership return;

it 204 ip instructions form Fill out & sign online DocHub

But every partnership having either (1) at least one. Web 19 rows partnership return; Get the it 204 ip form you want. Find the template from the library. Partnerships are not subject to personal income tax.

IP 204 Pill Everything You should Know Public Health

Get the it 204 ip form you want. If this form is desired. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. Used to report income, deductions, gains, losses and. This form is only prepared for individual, estate and trust or partnership partners.

Form IT204IP Download Fillable PDF or Fill Online New York Partner's

Get the it 204 ip form you want. Used to report income, deductions, gains, losses and. But every partnership having either (1) at least one. Find the template from the library. This form is only prepared for individual, estate and trust or partnership partners.

Fillable It204Ip New York Partner'S Schedule K1 printable pdf download

17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. Find the template from the library. Web 19 rows partnership return; Get the it 204 ip form you want. But every partnership having either (1) at least one.

Find the template from the library. Used to report income, deductions, gains, losses and. But every partnership having either (1) at least one. Web 19 rows partnership return; Get the it 204 ip form you want. If this form is desired. This form is only prepared for individual, estate and trust or partnership partners. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. Partnerships are not subject to personal income tax.

This Form Is Only Prepared For Individual, Estate And Trust Or Partnership Partners.

17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. Web 19 rows partnership return; Find the template from the library. But every partnership having either (1) at least one.

Partnerships Are Not Subject To Personal Income Tax.

Get the it 204 ip form you want. If this form is desired. Used to report income, deductions, gains, losses and.