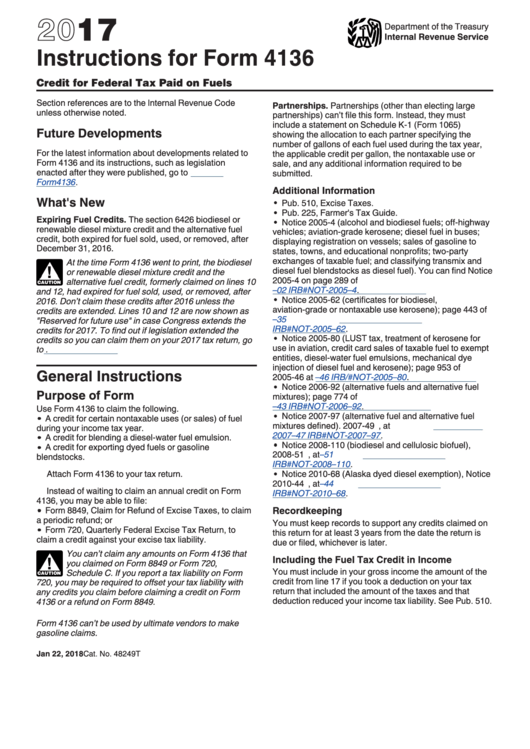

Instructions For Form 4136 - If any of the diesel fuel. Web general instructions purpose of form use form 4136 to claim the following. Web go to www.irs.gov/form4136 for instructions and the latest information. Provide the name and the id number of the taxpayer; Web follow the instructions for form 4136 to complete it: Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels go to. Web jan 12, 2021 instead of waiting to claim an annual credit on form 4136, you may be able to file: The biodiesel or renewable diesel mixture. The act made the following changes to the definition of renewable. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on.

Fillable Online Form 4136 Credit for Federal Tax Paid on Fuels (And

Provide the name and the id number of the taxpayer; The biodiesel or renewable diesel mixture. Web general instructions purpose of form use form 4136 to claim the following. Web use form 4136 to claim a credit for the federal excise tax on fuels sold or used for nontaxable uses (or sales) of fuel during. Web form 4136 a form.

14_700_SOV.indd. Instructions For Form 4136, Credit For Federal Tax

To see which fuel credits are still available, go to irs instructions for form 4136 credit for. The biodiesel or renewable diesel mixture. Web general instructions purpose of form use form 4136 to claim the following. Web irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the type of.

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

To see which fuel credits are still available, go to irs instructions for form 4136 credit for. The act made the following changes to the definition of renewable. Web go to www.irs.gov/form4136 for instructions and the latest information. Web follow the instructions for form 4136 to complete it: The biodiesel or renewable diesel mixture.

How to Prepare IRS Form 4136 (with Form) wikiHow

Provide the name and the id number of the taxpayer; Web department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for. Web applicable, the statement of biodiesel reseller, both of which have been edited as discussed in the instructions for form. Web jan 12, 2021 instead of waiting to claim an annual.

Instructions For Form 4136 2005 printable pdf download

Web follow the instructions for form 4136 to complete it: Web irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the type of fuels used, and. Tax credits are more powerful than tax deductions, which simply reduce the amount of your income that’s subject to tax. Web general instructions.

Form 4136 Fill and Sign Printable Template Online

Web general instructions purpose of form use form 4136 to claim the following. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels go to. Provide the name and the id number of the taxpayer; The biodiesel or renewable diesel mixture. Credit for certain nontaxable uses (or sales) of fuel.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels go to. Web applicable, the statement of biodiesel reseller, both of which have been edited as discussed in the instructions for form. Web general instructions purpose of form use form 4136 to claim the following. To see which fuel credits are still.

Instructions for IRS Form 4136 Credit for Federal Tax Paid on Fuels

Form 8849, claim for refund of. Web follow the instructions for form 4136 to complete it: Web applicable, the statement of biodiesel reseller, both of which have been edited as discussed in the instructions for form. Web general instructions purpose of form use form 4136 to claim the following. Go to www.freetaxusa.com to start your free.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Web follow the instructions for form 4136 to complete it: The biodiesel or renewable diesel mixture. Web jan 12, 2021 instead of waiting to claim an annual credit on form 4136, you may be able to file: Web go to www.irs.gov/form4136 for instructions and the latest information. Web general instructions purpose of form use form 4136 to claim the following.

Fillable Online irs form 4136 2012 Fax Email Print pdfFiller

Web jan 12, 2021 instead of waiting to claim an annual credit on form 4136, you may be able to file: Provide the name and the id number of the taxpayer; •a credit for certain nontaxable uses (or sales) of. Web crn $ 3 nontaxable use of undyed diesel fuel claimant certifies that the diesel fuel did not contain visible.

Web department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for. Web jan 12, 2021 instead of waiting to claim an annual credit on form 4136, you may be able to file: Web applicable, the statement of biodiesel reseller, both of which have been edited as discussed in the instructions for form. The act made the following changes to the definition of renewable. Web general instructions purpose of form use form 4136 to claim the following. If you have $243 worth of credits, for example, that cuts your tax bill by the full $243. Web go to www.irs.gov/form4136 for instructions and the latest information. If any of the diesel fuel. •a credit for certain nontaxable uses (or sales) of. Form 8849, claim for refund of. To see which fuel credits are still available, go to irs instructions for form 4136 credit for. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels go to. Web form 4136 a form that one files with the irs to claim a tax credit for certain federal excise taxes paid on automotive fuel. Go to www.freetaxusa.com to start your free. Web irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the type of fuels used, and. The biodiesel or renewable diesel mixture. Web use form 4136 to claim a credit for the federal excise tax on fuels sold or used for nontaxable uses (or sales) of fuel during. Web follow the instructions for form 4136 to complete it: Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully updated. The biodiesel or renewable diesel mixture.

Web Jan 12, 2021 Instead Of Waiting To Claim An Annual Credit On Form 4136, You May Be Able To File:

Tax credits are more powerful than tax deductions, which simply reduce the amount of your income that’s subject to tax. The act made the following changes to the definition of renewable. Web general instructions purpose of form use form 4136 to claim the following. To see which fuel credits are still available, go to irs instructions for form 4136 credit for.

Web Irs Form 4136, Credit For Federal Tax Paid On Fuels, Enables Certain Taxpayers To Claim A Fuel Credit, Depending On The Type Of Fuels Used, And.

The biodiesel or renewable diesel mixture. Web applicable, the statement of biodiesel reseller, both of which have been edited as discussed in the instructions for form. •a credit for certain nontaxable uses (or sales) of. Web follow the instructions for form 4136 to complete it:

Web Form 4136 A Form That One Files With The Irs To Claim A Tax Credit For Certain Federal Excise Taxes Paid On Automotive Fuel.

Web general instructions purpose of form use form 4136 to claim the following. The biodiesel or renewable diesel mixture. Web crn $ 3 nontaxable use of undyed diesel fuel claimant certifies that the diesel fuel did not contain visible evidence of dye. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on.

If Any Of The Diesel Fuel.

Web go to www.irs.gov/form4136 for instructions and the latest information. Form 8849, claim for refund of. Credit for certain nontaxable uses (or sales) of fuel. Provide the name and the id number of the taxpayer;