K 40 Tax Form - Web kansas tax forms 2022. Individual income tax supplemental schedule. Web adjusted gross income chart for use tax computation. You do not qualify for this credit. If line “d” is more than $30,615, stop here; Individual income tax kansas itemized deductions. Kansas tax form, send your request through email at. Find your kansas adjusted gross income in the chart and enter the. Amended returns must be filed within three years of when. Web your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less.

Fillable Form K40 Kansas Individual Tax And/or Food Sales Tax

Web state and local income taxes on line 5* of federal schedule a. Web kansas tax forms 2022. Web your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. This form is for income earned. Amended returns must be filed within three years of when.

Free Printable Federal Tax Forms Printable Forms Free Online

If line “d” is more than $30,615, stop here; This form is for income earned. Web adjusted gross income chart for use tax computation. You do not qualify for this credit. (subtract line 2 from line 1).

Form K40 Kansas Individual Tax 2005 printable pdf download

You do not qualify for this credit. Amended returns must be filed within three years of when. Web adjusted gross income chart for use tax computation. Web kansas tax forms 2022. (subtract line 2 from line 1).

2018 Form KS DoR K40 Fill Online, Printable, Fillable, Blank pdfFiller

Kansas tax form, send your request through email at. You may use the chart or compute the tax. Web state and local income taxes on line 5* of federal schedule a. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web kansas tax forms 2022.

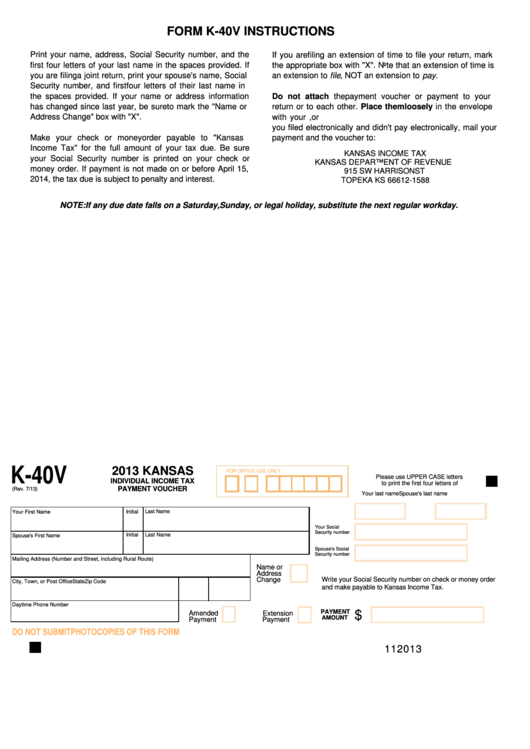

Fillable Form K40v Kansas Individual Tax Payment Voucher

Individual income tax kansas itemized deductions. You do not qualify for this credit. If line “d” is more than $30,615, stop here; You may use the chart or compute the tax. (subtract line 2 from line 1).

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Web submit your information on the proper form. Enter this amount on line 4 of form k. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: You do not qualify for this credit. Individual income tax supplemental schedule.

Form K 40 Kansas Individual Tax YouTube

Enter this amount on line 4 of form k. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Amended returns must be filed within three years of when. If line “d” is more than $30,615, stop here; Web the form 2021:

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Individual income tax supplemental schedule. Web state and local income taxes on line 5* of federal schedule a. 1) you are required to. Web submit your information on the proper form.

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

Individual income tax kansas itemized deductions. (subtract line 2 from line 1). Web adjusted gross income chart for use tax computation. Find your kansas adjusted gross income in the chart and enter the. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if:

Fillable Form K40 Kansas Individual Tax Return 2015

Kansas tax form, send your request through email at. Web adjusted gross income chart for use tax computation. Web the form 2021: Web submit your information on the proper form. Enter this amount on line 4 of form k.

(subtract line 2 from line 1). This form is for income earned. Web your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less. Web state and local income taxes on line 5* of federal schedule a. 1) you are required to. Amended returns must be filed within three years of when. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web submit your information on the proper form. Find your kansas adjusted gross income in the chart and enter the. Web kansas tax forms 2022. Kansas tax form, send your request through email at. If line “d” is more than $30,615, stop here; You do not qualify for this credit. Web yes were you (or spouse) totally and permanently disabled or blind all of 2022, regardless of age? Individual income tax supplemental schedule. Enter this amount on line 4 of form k. Web the form 2021: Individual income tax kansas itemized deductions. You may use the chart or compute the tax. Web adjusted gross income chart for use tax computation.

Web Kansas Tax Forms 2022.

Individual income tax kansas itemized deductions. Web submit your information on the proper form. (subtract line 2 from line 1). Enter this amount on line 4 of form k.

Amended Returns Must Be Filed Within Three Years Of When.

1) you are required to. This form is for income earned. If line “d” is more than $30,615, stop here; You do not qualify for this credit.

Web Yes Were You (Or Spouse) Totally And Permanently Disabled Or Blind All Of 2022, Regardless Of Age?

Kansas tax form, send your request through email at. Web state and local income taxes on line 5* of federal schedule a. Web the form 2021: Find your kansas adjusted gross income in the chart and enter the.

Web Adjusted Gross Income Chart For Use Tax Computation.

Individual income tax supplemental schedule. You may use the chart or compute the tax. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web your estimated kansas income tax after withholding and credits is $500 or more and your withholding and credits may be less.