New Mexico State Income Tax Forms - Welcome to the taxation and revenue department’s online services page. Web state of new mexico taxation and revenue department. Web personal income tax in new mexico starts with the federally adjusted gross income (fagi) from your federal return. File your taxes and manage your account online. Web we last updated the individual income tax instructions in january 2023, so this is the latest version of income tax instructions,. The current tax year is 2022, and most. Web new mexico’s law says every person with income from new mexico sources required to file a federal income tax return must file a. Web taxformfinder provides printable pdf copies of 81 current new mexico income tax forms. Web 55 rows new mexico has a state income tax that ranges between 1.7% and 5.9%, which is administered by the new mexico taxation. Web if you are a taxpayer in new mexico, you can use the taxpayer access point (tap) to file your taxes, make payments, check refund.

Form Pit1 New Mexico Personal Tax 2012 printable pdf download

Web taxformfinder provides printable pdf copies of 81 current new mexico income tax forms. The new mexico income tax has five tax brackets, with a. Web your online tax center. Web personal income tax in new mexico starts with the federally adjusted gross income (fagi) from your federal return. Web 55 rows new mexico has a state income tax that.

Form Crs1 Combined Report System (Long Form) State Of New Mexico

If you file your new mexico personal income tax return online and also pay tax due online, your due date is may. Welcome to the taxation and revenue department’s online services page. Calculate your required annual payment. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax. Web taxformfinder provides.

Form Pit8453 Individual Tax Declaration For Electronic Filing

The current tax year is 2022, and most. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Calculate your required annual payment. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax. If you file your new mexico personal income tax.

Form PitX New Mexico Personal Tax 2007 printable pdf download

Web alculation of estimated ersonal income ax underpayment enalty section 2: Web personal income tax in new mexico starts with the federally adjusted gross income (fagi) from your federal return. Web online new mexico state taxes and all available tax forms are on efile.com. File your taxes and manage your account online. The current tax year is 2022, and most.

Form Rpd41317 Solar Market Development Tax Credit Claim Form State

Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website. Web personal income tax in new mexico starts with the federally adjusted gross income (fagi) from your federal return. Web we last updated the individual income tax instructions in january 2023, so this is the latest version of income.

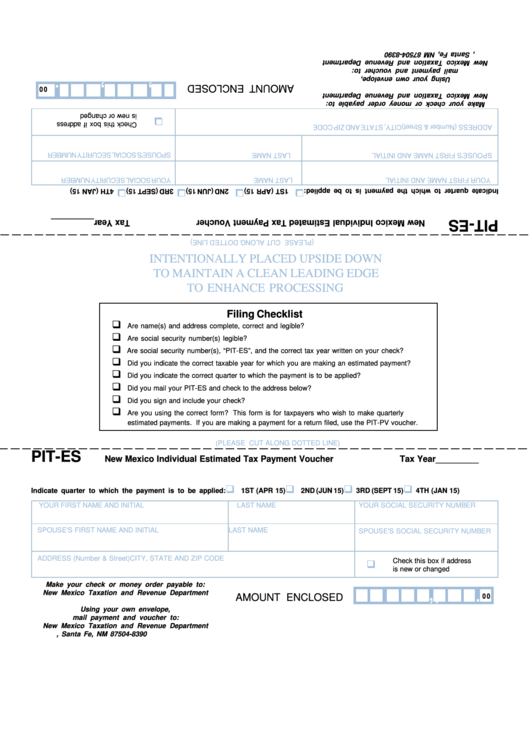

20182023 Form NM PITESFill Online, Printable, Fillable, Blank pdfFiller

Welcome to the taxation and revenue department’s online services page. The current tax year is 2022, and most. Web if you are a taxpayer in new mexico, you can use the taxpayer access point (tap) to file your taxes, make payments, check refund. New mexico taxpayer access point (tap). Web online new mexico state taxes and all available tax forms.

New Mexico State Withholding Form 2019 Fill Out and Sign Printable

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax. Welcome to the taxation and revenue department’s online services page. Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website. Calculate your required annual payment. Web new mexico’s law.

Form Rpd41260 Personal Tax Change Of Adress Form State Of

Web your online tax center. New mexico state income tax forms for current and. New mexico taxpayer access point (tap). The new mexico income tax has five tax brackets, with a. Web printable new mexico state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31,.

Form SCorp New Mexico Corporate And Franchise Tax Return

Calculate your required annual payment. New mexico taxpayer access point (tap). The new mexico income tax has five tax brackets, with a. Web state of new mexico taxation and revenue department. The current tax year is 2022, and most.

Form PitEs New Mexico Individual Estimated Tax Payment Voucher

Welcome to the taxation and revenue department’s online services page. New mexico state income tax forms for current and. Web we last updated the individual income tax instructions in january 2023, so this is the latest version of income tax instructions,. Web taxformfinder provides printable pdf copies of 81 current new mexico income tax forms. Web alculation of estimated ersonal.

New mexico state income tax forms for current and. The current tax year is 2022, and most. Calculate your required annual payment. Web it administers more than 35 tax programs and distributes revenue to the state and to local and tribal governments. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may. Web printable new mexico state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31,. Web state of new mexico taxation and revenue department. Web alculation of estimated ersonal income ax underpayment enalty section 2: File your taxes and manage your account online. Web taxformfinder provides printable pdf copies of 81 current new mexico income tax forms. Web new mexico’s law says every person with income from new mexico sources required to file a federal income tax return must file a. Web personal income tax in new mexico starts with the federally adjusted gross income (fagi) from your federal return. Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website. New mexico taxpayer access point (tap). Web 55 rows new mexico has a state income tax that ranges between 1.7% and 5.9%, which is administered by the new mexico taxation. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Web if you are a taxpayer in new mexico, you can use the taxpayer access point (tap) to file your taxes, make payments, check refund. Web your online tax center. The new mexico income tax has five tax brackets, with a. Web online new mexico state taxes and all available tax forms are on efile.com.

File Your Taxes And Manage Your Account Online.

The current tax year is 2022, and most. Web if you are a taxpayer in new mexico, you can use the taxpayer access point (tap) to file your taxes, make payments, check refund. Calculate your required annual payment. Web taxformfinder provides printable pdf copies of 81 current new mexico income tax forms.

Web Your Online Tax Center.

Web it administers more than 35 tax programs and distributes revenue to the state and to local and tribal governments. Web online new mexico state taxes and all available tax forms are on efile.com. The new mexico income tax has five tax brackets, with a. Web new mexico’s law says every person with income from new mexico sources required to file a federal income tax return must file a.

Web Personal Income Tax And Corporate Income Tax Forms For The 2021 Tax Year Are Now Available Online.

Web printable new mexico state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31,. New mexico taxpayer access point (tap). Web the new mexico personal income tax forms and instructions for the 2020 tax year are available on the department’s website. New mexico state income tax forms for current and.

Web 55 Rows New Mexico Has A State Income Tax That Ranges Between 1.7% And 5.9%, Which Is Administered By The New Mexico Taxation.

Welcome to the taxation and revenue department’s online services page. Web state of new mexico taxation and revenue department. Web alculation of estimated ersonal income ax underpayment enalty section 2: Web personal income tax in new mexico starts with the federally adjusted gross income (fagi) from your federal return.