Ri Income Tax Forms - Web if you are looking for tax forms for rhode island, you can find them on the official website of the ri division of taxation. Web 51 rows taxformfinder provides printable pdf copies of 79 current rhode island income tax forms. The current tax year is. All forms supplied by the division of taxation are in adobe acrobat (pdf) format; Web personal income tax forms. Web complete the respective rhode island tax form (s) then download, print, sign, and mail them to the rhode island division of. As you can see your income in rhode island is taxed at different rates within the given. Web individual tax forms are organized by tax type. Web to have forms mailed to you, please call 401.574.8970 or email [email protected]; Web form 1040nr is a rhode island individual income tax form.

RI DoT RI1040 2016 Fill out Tax Template Online US Legal Forms

Many states have separate versions of their tax returns for. The current tax year is. Web employer tax forms and resources provided by the rhode island department of revenue division of taxation. All forms supplied by the division of taxation are in adobe acrobat (pdf) format; As you can see your income in rhode island is taxed at different rates.

Form Ri1040 Rhode Island Resident Individual Tax Return 2001

Web employer tax forms and resources provided by the rhode island department of revenue division of taxation. Web 51 rows taxformfinder provides printable pdf copies of 79 current rhode island income tax forms. Web form 1040nr is a rhode island individual income tax form. As you can see your income in rhode island is taxed at different rates within the.

Form RI1120ES Download Fillable PDF or Fill Online State of Rhode

Web complete the respective rhode island tax form (s) then download, print, sign, and mail them to the rhode island division of. Web check the status of your state tax refund. As you can see your income in rhode island is taxed at different rates within the given. This form is for income. Click on the appropriate category below to.

Ri Fillable Tax Forms Printable Forms Free Online

Web view all 79 rhode island income tax forms. All forms supplied by the division of taxation are in adobe acrobat (pdf) format; Web rhode island income taxes and ri state tax forms. Many states have separate versions of their tax returns for. Web if you are looking for tax forms for rhode island, you can find them on the.

Form Ri1041 Rhode Island Fiduciary Tax Return 2007

Web view all 79 rhode island income tax forms. Web check the status of your state tax refund. Web rhode island income taxes and ri state tax forms. Many states have separate versions of their tax returns for. Web to have forms mailed to you, please call 401.574.8970 or email [email protected];

Form Ri1041 State Of Rhode Island Fiduciary Tax Return 2000

All forms supplied by the division of taxation are in adobe acrobat (pdf) format; Many states have separate versions of their tax returns for. Web rhode island has a state income tax that ranges between 3.75% and 5.99%. Web rhode island tax brackets for tax year 2022. Web 51 rows taxformfinder provides printable pdf copies of 79 current rhode island.

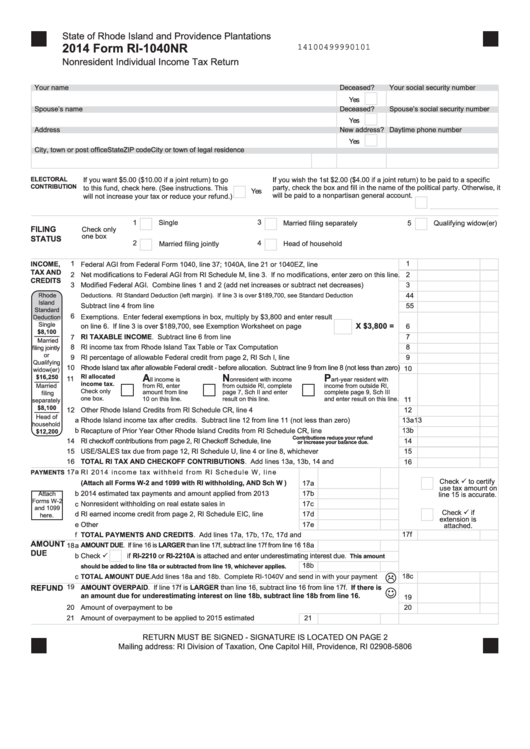

Fillable Form Ri1040nr Nonresident Individual Tax Return

Web employer tax forms and resources provided by the rhode island department of revenue division of taxation. Web rhode island has a state income tax that ranges between 3.75% and 5.99%. Web personal income tax forms. Web rhode island income taxes and ri state tax forms. As you can see your income in rhode island is taxed at different rates.

Fillable Form Ri2210 Underpayment Of Estimated Tax By Individuals

Web if you are looking for tax forms for rhode island, you can find them on the official website of the ri division of taxation. Rhode island usually releases forms for the current tax year between. Web we last updated rhode island form 1040 in february 2023 from the rhode island division of taxation. The rhode island income tax has.

Form Ri1041 Rhode Island Fiduciary Tax Return 2004

Web if you are looking for tax forms for rhode island, you can find them on the official website of the ri division of taxation. Web 51 rows taxformfinder provides printable pdf copies of 79 current rhode island income tax forms. Web individual tax forms are organized by tax type. All forms supplied by the division of taxation are in.

Form Ri1040s Resident Individual Tax Return 2010 printable

Web complete the respective rhode island tax form (s) then download, print, sign, and mail them to the rhode island division of. Web check the status of your state tax refund. Web rhode island has a state income tax that ranges between 3.75% and 5.99%. Web form 1040nr is a rhode island individual income tax form. Web 51 rows taxformfinder.

Web if you are looking for tax forms for rhode island, you can find them on the official website of the ri division of taxation. Web view all 79 rhode island income tax forms. Web 51 rows taxformfinder provides printable pdf copies of 79 current rhode island income tax forms. Web employer tax forms and resources provided by the rhode island department of revenue division of taxation. The current tax year is. The rhode island income tax has three tax brackets,. Web personal income tax forms. Web form 1040nr is a rhode island individual income tax form. Web rhode island tax brackets for tax year 2022. Web check the status of your state tax refund. This form is for income. Select the tax type of the form you are looking for to be directed to that page. Web complete the respective rhode island tax form (s) then download, print, sign, and mail them to the rhode island division of. Rhode island usually releases forms for the current tax year between. All forms supplied by the division of taxation are in adobe acrobat (pdf) format; Web rhode island income taxes and ri state tax forms. Web rhode island has a state income tax that ranges between 3.75% and 5.99%. Many states have separate versions of their tax returns for. Starting with the return for the period ending january 2023 [filed in. Web individual tax forms are organized by tax type.

The Current Tax Year Is.

Many states have separate versions of their tax returns for. The rhode island income tax has three tax brackets,. Web check the status of your state tax refund. Web complete the respective rhode island tax form (s) then download, print, sign, and mail them to the rhode island division of.

Web Personal Income Tax Forms.

Web view all 79 rhode island income tax forms. Web employer tax forms and resources provided by the rhode island department of revenue division of taxation. As you can see your income in rhode island is taxed at different rates within the given. Click on the appropriate category below to.

Starting With The Return For The Period Ending January 2023 [Filed In.

Web rhode island income taxes and ri state tax forms. Web 51 rows taxformfinder provides printable pdf copies of 79 current rhode island income tax forms. Web individual tax forms are organized by tax type. Web to have forms mailed to you, please call 401.574.8970 or email [email protected];

Web Rhode Island Tax Brackets For Tax Year 2022.

Web we last updated rhode island form 1040 in february 2023 from the rhode island division of taxation. Web form 1040nr is a rhode island individual income tax form. This form is for income. All forms supplied by the division of taxation are in adobe acrobat (pdf) format;