Schedule A Form 5500 Instructions - Form 5500 must be filed by the last day of the seventh calendar month after. Web see what to file. Web schedule, such as the schedule a (form 5500). Web form 5500 will vary according to the type of plan or arrangement. An annual return/report must be filed for employee welfare. Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. The section what to file summarizes what information must. Department of labor, internal revenue service, and the pension benefit guaranty corporation. 48 min.9 hr., 32 min. Web form 5500 is used for plans that have 100 or more participants.

IRS Form 5500 Schedule D Download Fillable PDF or Fill Online Dfe

48 min.9 hr., 32 min. See the instructions for schedules on page 6. Web today, the u.s. Signing and submitting the form 5500 means a ton of risk on your. Web when you sign form 5500, you’re personally liable for the 401 (k).

Form 5500 Schedule Mb Multiemployer Defined Benefit Plan And

Web there’s a lot that goes into completing the form 5500, with its 27 pages of instructions. Web when and how do i file form 5500? Web form 5500 annual return/report of employee benefit plan | instructions; Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web one.

Form 5500 Instructions 5 Steps to Filing Correctly

Schedule a (form 5500) 17 hr., 28 min. Web today, the u.s. Web see what to file. An annual return/report must be filed for employee welfare. Web form 5500 instructions 2020 series was jointly designed by the department of labor (dol), the internal revenue service (irs),.

Understanding the Form 5500 for Defined Benefit Plans Fidelity

Signing and submitting the form 5500 means a ton of risk on your. Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. Form 5500 must be filed by the last day of the seventh calendar month after. Web generally, any business that sponsors a retirement savings plan must file.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

See the instructions for schedules on page 6. An annual return/report must be filed for employee welfare. 29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax filing extension. Schedule a (form 5500) 17 hr., 28 min. Form 5500 must be filed by the last day of the seventh calendar month after.

2018 Updated Form 5500EZ Guide Solo 401k

29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax filing extension. An annual return/report must be filed for employee welfare. See the instructions for schedules on page 6. Web see what to file. Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa).

Form 5500 Instructions 5 Steps to Filing Correctly

Web schedule, such as the schedule a (form 5500). This is why so many employers rely on their 401(k). Web form 5500 instructions 2020 series was jointly designed by the department of labor (dol), the internal revenue service (irs),. Web form 5500 will vary according to the type of plan or arrangement. Web form 5500 reporting requirements, and whether a.

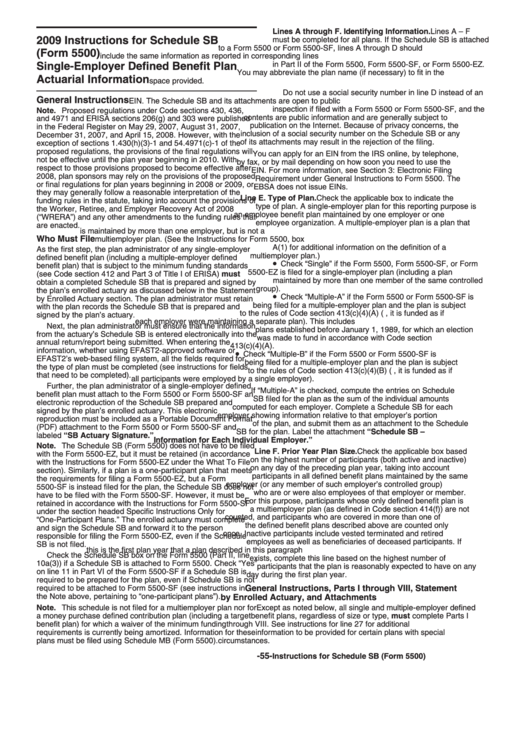

2009 Instructions For Schedule Sb (Form 5500) SingleEmployer Defined

Web there’s a lot that goes into completing the form 5500, with its 27 pages of instructions. Web form 5500 is used for plans that have 100 or more participants. Web schedule a (form 5500) must be attached to the form 5500 filed for every defined benefit pension plan, defined contribution pension. Web this clarification is proposed to be added.

Form 5500 Fill Out and Sign Printable PDF Template signNow

Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds. Schedule a (form 5500) 17 hr., 28 min. Web when and how do i file form 5500? Web schedule, such as the schedule a (form 5500). An annual return/report must be filed for employee welfare.

Form 5500 Schedule A Instructions Insurance Information 2002

Web generally, any business that sponsors a retirement savings plan must file a form 5500 each year that the plan holds. Web one is filing form 5500, which summarizes your company’s compliance with employee benefit plans (ebps). Form 5500 must be filed by the last day of the seventh calendar month after. Web form 5500 annual return/report of employee benefit.

This schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). This is why so many employers rely on their 401(k). Web form 5500 instructions 2020 series was jointly designed by the department of labor (dol), the internal revenue service (irs),. 29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax filing extension. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including. The section what to file summarizes what information must. Web form 5500 (all other filers) 82 hr., 16 min. Web schedule a (form 5500) must be attached to the form 5500 filed for every defined benefit pension plan, defined contribution pension. An annual return/report must be filed for employee welfare. Web there’s a lot that goes into completing the form 5500, with its 27 pages of instructions. Department of labor, internal revenue service, and the pension benefit guaranty corporation. Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web form 5500 annual return/report of employee benefit plan | instructions; See the instructions for schedules on page 6. Form 5500 must be filed by the last day of the seventh calendar month after. Web when and how do i file form 5500? Signing and submitting the form 5500 means a ton of risk on your. 48 min.9 hr., 32 min. Web when you sign form 5500, you’re personally liable for the 401 (k). Web see what to file.

Web See What To File.

Web this clarification is proposed to be added to the 2023 form 5500 instructions for line 26b of schedule sb. 29, 2023 — the internal revenue service today reminded taxpayers about the upcoming tax filing extension. 48 min.9 hr., 32 min. Signing and submitting the form 5500 means a ton of risk on your.

Web Form 5500 Annual Return/Report Of Employee Benefit Plan | Instructions;

Form 5500 must be filed by the last day of the seventh calendar month after. See the instructions for schedules on page 6. Web when and how do i file form 5500? Schedule a (form 5500) 17 hr., 28 min.

Web Generally, Any Business That Sponsors A Retirement Savings Plan Must File A Form 5500 Each Year That The Plan Holds.

This is why so many employers rely on their 401(k). Web filing a form 5500 annual return/report of employee benefit plan (form 5500) or, if eligible, a form. The section what to file summarizes what information must. Web when you sign form 5500, you’re personally liable for the 401 (k).

This Schedule Is Required To Be Filed Under Section 104 Of The Employee Retirement Income Security Act Of 1974 (Erisa).

Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa). Web one is filing form 5500, which summarizes your company’s compliance with employee benefit plans (ebps). Web there’s a lot that goes into completing the form 5500, with its 27 pages of instructions. Web today, the u.s.