Tennessee Farm Tax Exempt Form - Web beginning january 1, 2023, qualified farmers and nursery operators may purchase building material, fencing. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must. Web farm bureau is advocating the law should provide consistency in application for items used to cultivate, produce, harvest,. Web (correct answer) how to become farm tax exempt in tn? There is an exemption available to farmers, timber harvesters, nursery operators, and dealers. Web purchases exempt from sales tax. Website on ag sales tax. Web instructions application for registration agricultural sales and use tax certificate of exemption instructions: Web the tennessee department of revenue now offers an “agricultural sales and use tax exemption” to qualified. Web february 2021 qualifying farmers, nursery operators, and timber harvesters to receive an exemption certificate, an application.

Farm Tax Exempt Form Tn

There is an exemption available to farmers, timber harvesters, nursery operators, and dealers. (correct answer) to receive an agricultural sales. Web what’s going on with your farm bureau, tennessee agriculture and much more delivered straight to your inbox. What items qualify for the exemption. Web beginning january 1, 2023, qualified farmers and nursery operators may purchase building material, fencing.

Ohio Farm Sales Tax Exemption Form Tax

(correct answer) to receive an agricultural sales. What items qualify for the exemption. Web the tennessee department of revenue now offers an “agricultural sales and use tax exemption” to qualified. Web february 2021 qualifying farmers, nursery operators, and timber harvesters to receive an exemption certificate, an application. Web purchases exempt from sales tax.

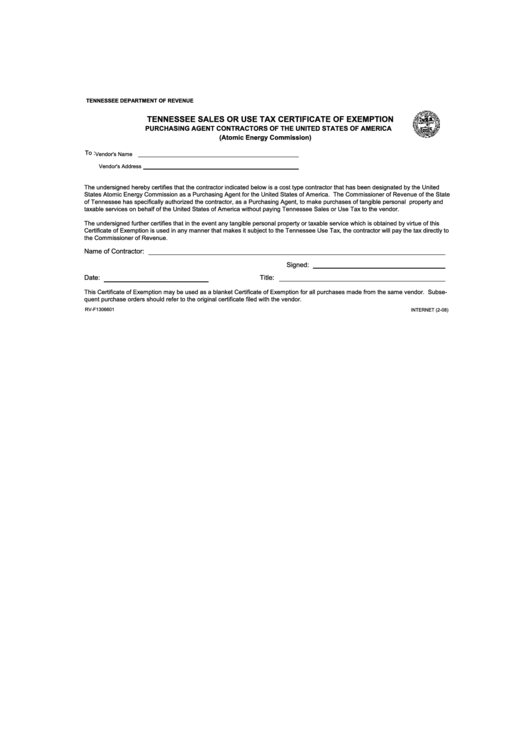

Tennessee Sales Or Use Tax Certificate Of Exemption printable pdf download

What items qualify for the exemption. Web a qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax. Web purchases exempt from sales tax. (correct answer) to receive an agricultural sales. Web the application for the exemption is available on the tennessee department of revenue website.

Form RvF1302901 Exemption Certification For Farm Equipment And

Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain the agricultural. (correct answer) to receive an agricultural sales. Web what’s going on with your farm bureau, tennessee agriculture and much more delivered straight to your inbox. Web a qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural.

Fillable Form RvF1306901 Sales And Use Tax Exempt Entities Or State

There is an exemption available to farmers, timber harvesters, nursery operators, and dealers. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain an agricultural. Web what’s going on with your farm bureau, tennessee agriculture and much more delivered straight to your inbox. Web the application for the exemption is available on the.

Form RvF1320101 Tennessee Sales Or Use Tax Certificate Of Exemption

Web (correct answer) how to become farm tax exempt in tn? Web a qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax. Web the application for the exemption is available on the tennessee department of revenue website. Web purchases exempt from sales tax. Web a tennessee farmer, timber harvester, or nursery.

Tn Tax Exempt Form Forms Fill Out And Sign Printable PDF Template

Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain the agricultural. Web the tennessee department of revenue now offers an “agricultural sales and use tax exemption” to qualified. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain an agricultural. Web this page provides important.

Form RVF1308401 Download Fillable PDF or Fill Online Application for

This application for registration is to be used to obtain a tennnessee agricultural sales or use tax exemption. Web february 2021 qualifying farmers, nursery operators, and timber harvesters to receive an exemption certificate, an application. What items qualify for the exemption. Web the application for the exemption is available on the tennessee department of revenue website. Web what’s going on.

Certificate Of Exemption Instructions Tennessee Department Of Revenue

Web what’s going on with your farm bureau, tennessee agriculture and much more delivered straight to your inbox. This application for registration is to be used to obtain a tennnessee agricultural sales or use tax exemption. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain an agricultural. (correct answer) to receive an.

Form Reg8 Application For Farmer Tax Exemption Permit printable pdf

Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain the agricultural. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain the agricultural. Web farm bureau is advocating the law should provide consistency in application for items used to cultivate, produce, harvest,. (correct answer) to.

(correct answer) to receive an agricultural sales. Web a qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax. Web the tennessee department of revenue now offers an “agricultural sales and use tax exemption” to qualified. Web purchases exempt from sales tax. This application for registration is to be used to obtain a tennnessee agricultural sales or use tax exemption. Website on ag sales tax. There is an exemption available to farmers, timber harvesters, nursery operators, and dealers. Web this page provides important links for the tennessee agriculture sales and use exemptions. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain the agricultural. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain the agricultural. Web beginning january 1, 2023, qualified farmers and nursery operators may purchase building material, fencing. Web farm bureau is advocating the law should provide consistency in application for items used to cultivate, produce, harvest,. Web what’s going on with your farm bureau, tennessee agriculture and much more delivered straight to your inbox. Web february 2021 qualifying farmers, nursery operators, and timber harvesters to receive an exemption certificate, an application. Web instructions application for registration agricultural sales and use tax certificate of exemption instructions: What items qualify for the exemption. Web the application for the exemption is available on the tennessee department of revenue website. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must. Web (correct answer) how to become farm tax exempt in tn? Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain an agricultural.

There Is An Exemption Available To Farmers, Timber Harvesters, Nursery Operators, And Dealers.

Web farm bureau is advocating the law should provide consistency in application for items used to cultivate, produce, harvest,. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain the agricultural. Web (correct answer) how to become farm tax exempt in tn? Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain the agricultural.

Web The Tennessee Department Of Revenue Now Offers An “Agricultural Sales And Use Tax Exemption” To Qualified.

Web february 2021 qualifying farmers, nursery operators, and timber harvesters to receive an exemption certificate, an application. Web what’s going on with your farm bureau, tennessee agriculture and much more delivered straight to your inbox. This application for registration is to be used to obtain a tennnessee agricultural sales or use tax exemption. Web beginning january 1, 2023, qualified farmers and nursery operators may purchase building material, fencing.

Web Purchases Exempt From Sales Tax.

Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must. What items qualify for the exemption. Web this page provides important links for the tennessee agriculture sales and use exemptions. (correct answer) to receive an agricultural sales.

Web The Application For The Exemption Is Available On The Tennessee Department Of Revenue Website.

Web a qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax. Web instructions application for registration agricultural sales and use tax certificate of exemption instructions: Website on ag sales tax. Web a tennessee farmer, timber harvester, or nursery operator wishing to make tax exempt purchases must obtain an agricultural.