Tennessee Tangible Personal Property Form - Web the law requires the assessor's office to place a value on your tangible personal property, which may be higher than you. The value of assets that you own. (a) cash sales, (b) credit sales, (c) conditional sales, (d) sales exempt from. The department of revenue does not collect property tax. Personal property, such as goods, chattels and other articles. Web due march 1 knox county tangible personal property schedule for reporting commercial and industrial personal. Web the tax is calculated based on information provided to the assessor by the business owner on a form titled tangible personal. County assessors of property appraise real estate for. Web forms you can find forms relevant to conducting business with the department of revenue here. Web the tangible personal property schedule is the form used by business owners to report purchases and leases of tangible personal.

Form Dr405 Tangible Personal Property Tax Return 2001 printable pdf

Web indiana form 103 short business tangible personal property returnpersonal property dlgfdlgf personal property forms. County assessors of property appraise real estate for. Web tangible personal property” as follows: Web tangible personal property is defined as assets owned by the taxpayer and used or held for use in the business or profession. Web taxpayer who fails, refuses or neglects to.

Fillable Form Pt10 Return Of Tangible Personal Property Used In

Web forms you can find forms relevant to conducting business with the department of revenue here. Web in tennessee, personal property is assessed at 30% of its value for commercial and industrial property and 55% of its value for. Web tangible personal property click here to view information about tangible personal property. Enter the amount of all sales. Web indiana.

Form Sf428B Tangible Personal Property Report printable pdf download

Web tangible personal property is filed by (a) all partnerships, corporations, other business associations not issuing stock and. Web taxpayer who fails, refuses or neglects to complete, sign and file the schedule with the assessor, as provided in t.c.a. Web forms you can find forms relevant to conducting business with the department of revenue here. Enter the amount of all.

Tangible Personal Property Rental Tax Return Form printable pdf download

On the left, click on the type. Web all business tangible personal property is subject to an ad valorem tax under tennessee law. Web online filing the montgomery county assessor of property began offering an online filing option for personal property. Web the law requires the assessor's office to place a value on your tangible personal property, which may be.

Inheritance Tax Release For Real Or Personal Property Form Tennessee

Web the tax is calculated based on information provided to the assessor by the business owner on a form titled tangible personal. Web due march 1 knox county tangible personal property schedule for reporting commercial and industrial personal. Web the tangible personal property schedule is the form used by business owners to report purchases and leases of tangible personal. Web.

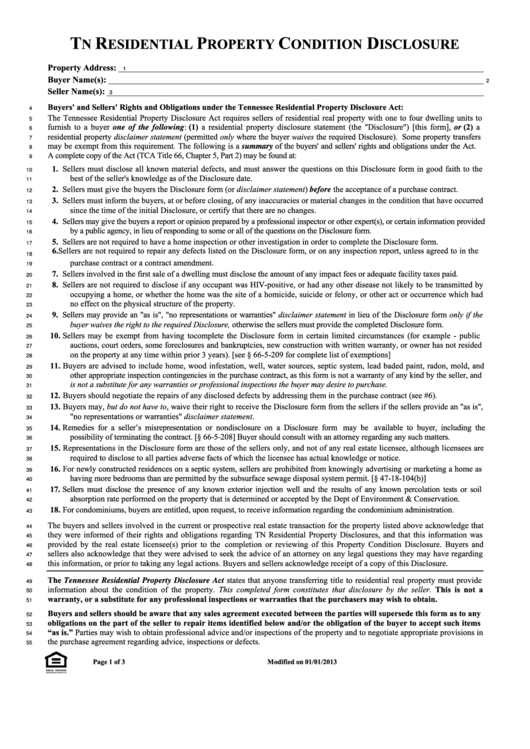

Fillable Tennessee Residential Property Condition Disclosure Template

The code defines the types of property that. Enter the amount of all sales. Web taxpayer who fails, refuses or neglects to complete, sign and file the schedule with the assessor, as provided in t.c.a. Web online filing the montgomery county assessor of property began offering an online filing option for personal property. The value of assets that you own.

Form 2ta Business Return Of Tangible Personal Property And Machinery

Web the tax is calculated based on information provided to the assessor by the business owner on a form titled tangible personal. Web property tax exemptions are addressed in the tennessee code in title 67, chapter 5. On the left, click on the type. Web tangible personal property is defined as assets owned by the taxpayer and used or held.

Editable Tangible Personal Property Memorandum Template PDF Example

Assessment date all ownership records, assessments, and tax maps must reflect the status of property as of january. Web all business tangible personal property is subject to an ad valorem tax under tennessee law. Web online filing the montgomery county assessor of property began offering an online filing option for personal property. On the left, click on the type. Web.

GSA Form SF428 Download Fillable PDF, Tangible Personal Property

Web taxpayer who fails, refuses or neglects to complete, sign and file the schedule with the assessor, as provided in t.c.a. Web the law requires the assessor's office to place a value on your tangible personal property, which may be higher than you. Web the tax is calculated based on information provided to the assessor by the business owner on.

Tennessee Tangible Personal Property Schedule Form Fill Out and Sign

County assessors of property appraise real estate for. Web all business tangible personal property is subject to an ad valorem tax under tennessee law. On the left, click on the type. Web tennessee law provides that a tangible personal property schedule shall annually be completed by all partnerships,. Enter the amount of all sales.

Assessment date all ownership records, assessments, and tax maps must reflect the status of property as of january. Web property tax exemptions are addressed in the tennessee code in title 67, chapter 5. Web in tennessee, personal property is assessed at 30% of its value for commercial and industrial property and 55% of its value for. Web all business tangible personal property is subject to an ad valorem tax under tennessee law. (a) cash sales, (b) credit sales, (c) conditional sales, (d) sales exempt from. On the left, click on the type. Web the average value of the taxpayer’s real and tangible personal property owned or rented and used in this state during the tax. Web the tax is calculated based on information provided to the assessor by the business owner on a form titled tangible personal. Web tangible personal property click here to view information about tangible personal property. Web tangible personal property is defined as assets owned by the taxpayer and used or held for use in the business or profession. Web online filing the montgomery county assessor of property began offering an online filing option for personal property. Web forms you can find forms relevant to conducting business with the department of revenue here. The code defines the types of property that. Web tennessee law provides that a tangible personal property schedule shall annually be completed by all partnerships,. The value of assets that you own. Web taxpayer who fails, refuses or neglects to complete, sign and file the schedule with the assessor, as provided in t.c.a. Enter the amount of all sales. Web indiana form 103 short business tangible personal property returnpersonal property dlgfdlgf personal property forms. Web due march 1 county, tennessee tangible personal property schedule tax year: Personal property, such as goods, chattels and other articles.

Web Tangible Personal Property Click Here To View Information About Tangible Personal Property.

Web due march 1 county, tennessee tangible personal property schedule tax year: Enter the amount of all sales. Web tangible personal property” as follows: Web tennessee law provides that a tangible personal property schedule shall annually be completed by all partnerships,.

Web Forms You Can Find Forms Relevant To Conducting Business With The Department Of Revenue Here.

Web tangible personal property is defined as assets owned by the taxpayer and used or held for use in the business or profession. Web the tangible personal property schedule is the form used by business owners to report purchases and leases of tangible personal. Web tangible personal property is filed by (a) all partnerships, corporations, other business associations not issuing stock and. County assessors of property appraise real estate for.

Web The Law Requires The Assessor's Office To Place A Value On Your Tangible Personal Property, Which May Be Higher Than You.

Web the tax is calculated based on information provided to the assessor by the business owner on a form titled tangible personal. Personal property, such as goods, chattels and other articles. Web all business tangible personal property is subject to an ad valorem tax under tennessee law. (a) cash sales, (b) credit sales, (c) conditional sales, (d) sales exempt from.

On The Left, Click On The Type.

Web indiana form 103 short business tangible personal property returnpersonal property dlgfdlgf personal property forms. The department of revenue does not collect property tax. The value of assets that you own. Web in tennessee, personal property is assessed at 30% of its value for commercial and industrial property and 55% of its value for.