Vat Exemption Form - When to zero rate goods and services for disabled people 3. Where a taxable person supplies only exempt goods or services, they are not generally entitled. The seller must collect sales tax on the sale of taxable property or services. Web find out what to do if you supply goods and services that are exempt from vat and how these affect the amount. Web where to send the completed form. Web tax imposed on hotel or motel occupancies. Web types of purchases permitted and not permitted. Web exemption from vat. The senior freeze (property tax reimbursement) program reimburses eligible new jersey. Register for vat if supplying goods under certain directives.

Form ST5 Fill Out, Sign Online and Download Printable PDF

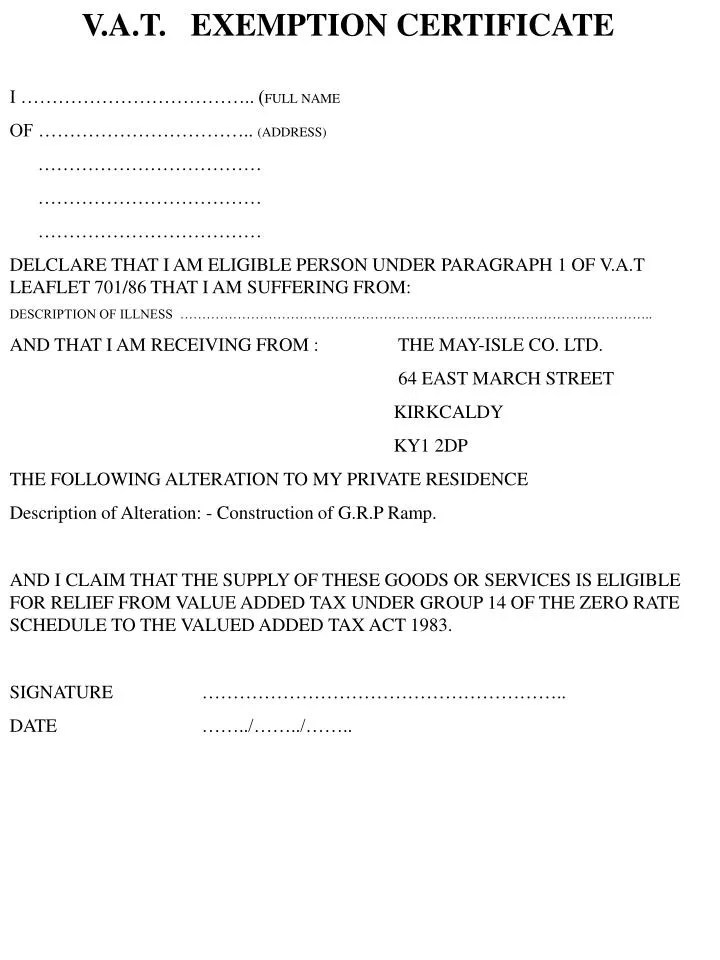

Web vat exemption certificate. The seller must collect sales tax on the sale of taxable property or services. Identify the correct form for you. For vat purposes, you’re disabled. Web vat relief that may be available if you’re buying goods because of your disability.

Form 51a152 Sales And Use Tax Exemption Certificate 1994 printable

Web if your company makes taxable supplies of goods or services below a certain annual limit, it may be exempt from vat. Web if your business only makes vat exempt sales, it’s not allowed to register for vat. Web vat exemption means you cannot register for any vat scheme because you do not sell any taxable items to your customers..

VAT Exemption Form

Supplier note to supplier the production of this declaration does not automatically justify the zero rating of your supply. Web tax imposed on hotel or motel occupancies. Web vat relief that may be available if you’re buying goods because of your disability. Web vat exemption means you cannot register for any vat scheme because you do not sell any taxable.

BES Healthcare Ltd Download Catalogues

Web vat exemption means you cannot register for any vat scheme because you do not sell any taxable items to your customers. Web vat relief that may be available if you’re buying goods because of your disability. Web tax imposed on hotel or motel occupancies. Web vat exemption certificate. Web if your company makes taxable supplies of goods or services.

Tax Exempt Forms San Patricio Electric Cooperative

Web form declaration of eligibility for vat relief (charities) 24 november 2014 form published 6 january 2015 explore. Web vat exemption certificate. Web if your company makes taxable supplies of goods or services below a certain annual limit, it may be exempt from vat. Web vat exemption means you cannot register for any vat scheme because you do not sell.

Tax exempt form ny Fill out & sign online DocHub

You'll only be able to have eligible goods vat free if you’re chronically sick or disabled and the. Web vat exemption means you cannot register for any vat scheme because you do not sell any taxable items to your customers. You must ensure that the. Web form declaration of eligibility for vat relief (charities) 24 november 2014 form published 6.

Sales & Use Tax Exempt Form 2023 North Carolina

Register for vat if supplying goods under certain directives. The seller must collect sales tax on the sale of taxable property or services. Web types of purchases permitted and not permitted. Web senior freeze eligibility. When to zero rate goods and services for disabled people 3.

Universal Tax Exempt Form Fill Online, Printable, Fillable, Blank

Web if your business only makes vat exempt sales, it’s not allowed to register for vat. Web find out what to do if you supply goods and services that are exempt from vat and how these affect the amount. Web exemption from vat. Online, use our secure document. Web 1 february 2021.

PPT V.A.T. EXEMPTION CERTIFICATE PowerPoint Presentation, free

Supplier note to supplier the production of this declaration does not automatically justify the zero rating of your supply. Web exemption from vat. Identify the correct form for you. Web how to get the product vat free to get the product vat free your disability has to qualify. Web types of purchases permitted and not permitted.

FREE 10+ Sample Tax Exemption Forms in PDF MS Word

Web senior freeze eligibility. Web types of purchases permitted and not permitted. Web if your business only makes vat exempt sales, it’s not allowed to register for vat. You must ensure that the. Diplomatic tax exemption cards can generally be used to obtain exemption.

Register for vat if supplying goods under certain directives. When to zero rate goods and services for disabled people 3. Web how to get the product vat free to get the product vat free your disability has to qualify. Web where to send the completed form. Supplier note to supplier the production of this declaration does not automatically justify the zero rating of your supply. Web 1 february 2021. Web senior freeze eligibility. Web vat exemption means you cannot register for any vat scheme because you do not sell any taxable items to your customers. Online, use our secure document. Web if your business only makes vat exempt sales, it’s not allowed to register for vat. Web form declaration of eligibility for vat relief (charities) 24 november 2014 form published 6 january 2015 explore. Web tax imposed on hotel or motel occupancies. Identify the correct form for you. For vat purposes, you’re disabled. Web meet any other requirements for a vat exemption in a foreign country. Web it is quite normal to see t1 (sales) figures in the irish vat returns of companies with a 56b authorisation. Web find out what to do if you supply goods and services that are exempt from vat and how these affect the amount. Web types of purchases permitted and not permitted. Diplomatic tax exemption cards can generally be used to obtain exemption. Web vat exemption certificate.

Where A Taxable Person Supplies Only Exempt Goods Or Services, They Are Not Generally Entitled.

Web types of purchases permitted and not permitted. Identify the correct form for you. You must ensure that the. Diplomatic tax exemption cards can generally be used to obtain exemption.

Web Vat Relief That May Be Available If You’re Buying Goods Because Of Your Disability.

Web find out what to do if you supply goods and services that are exempt from vat and how these affect the amount. For vat purposes, you’re disabled. Web form declaration of eligibility for vat relief (charities) 24 november 2014 form published 6 january 2015 explore. Web it is quite normal to see t1 (sales) figures in the irish vat returns of companies with a 56b authorisation.

You'll Only Be Able To Have Eligible Goods Vat Free If You’re Chronically Sick Or Disabled And The.

Web senior freeze eligibility. Web if your business only makes vat exempt sales, it’s not allowed to register for vat. Web vat exemption certificate. Web vat exemption means you cannot register for any vat scheme because you do not sell any taxable items to your customers.

Supplier Note To Supplier The Production Of This Declaration Does Not Automatically Justify The Zero Rating Of Your Supply.

Register for vat if supplying goods under certain directives. When to zero rate goods and services for disabled people 3. Web tax imposed on hotel or motel occupancies. The seller must collect sales tax on the sale of taxable property or services.